san francisco county sales tax rate

In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020 through May 4 2020 has been cancelled. 2020 rates included for use while preparing your income tax.

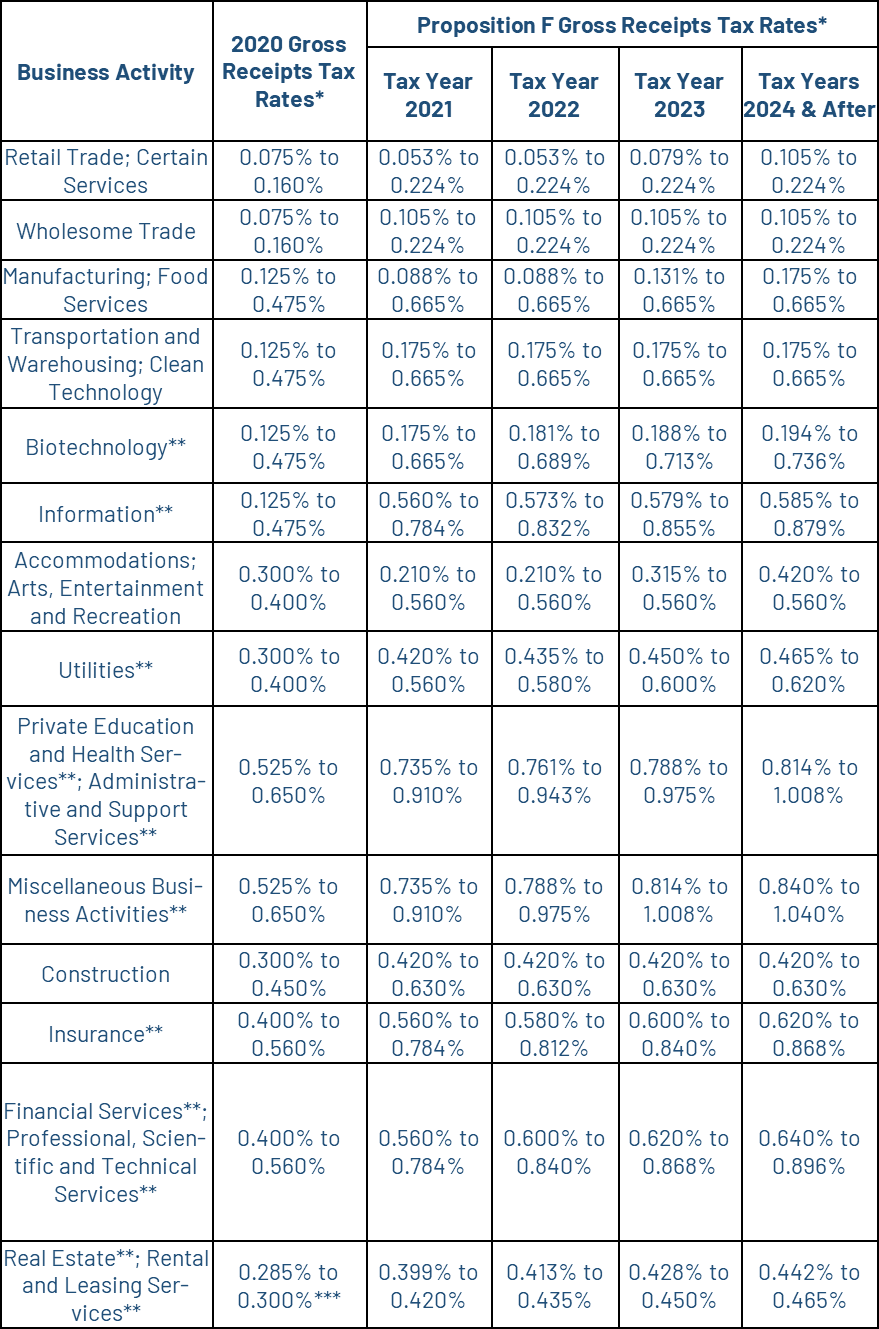

Gross Receipts Tax Gr Treasurer Tax Collector

This rate includes any state county city and local sales taxes.

. San Francisco has parts of it located within. The current total local sales tax rate in San Francisco County CA is 8625. This is the total of state and county sales tax rates.

List of Non-Timeshare Properties Auctioned. City Hall Office Hours. You can find more tax rates and allowances for San Francisco County and California in the 2022 California Tax Tables.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles. 0875 lower than the maximum sales tax in CA. The minimum combined 2022 sales tax rate for San Mateo County California is 938.

A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California. San Francisco County Sales Tax Rates for 2022. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1.

The December 2020 total local sales tax rate was 8500. The minimum combined 2022 sales tax rate for San Francisco County California is. The minimum combined 2022 sales tax rate for San Francisco California is.

2019 Public Auction. This county tax rate applies to areas that are within. The California state sales tax rate is currently.

Payroll Expense Tax. The total sales tax rate in any given location can be broken down into state county city and special district rates. Register for a Permit License or Account.

Monday through Friday in room 140. Walk-ins for assistance accepted until 4 pm. This rate includes any state county city and local sales taxes.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375. Re-Offer of Timeshare Properties Auctioned. When contacting San Francisco County about your property taxes make sure that you are contacting the correct office.

San Francisco County California Sales Tax Rate 2022 Up to 9875. While many other states allow counties and other localities to collect a local option sales tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the.

The California state sales tax rate is currently 6. List of Timeshare Properties Auctioned. The minimum combined 2022 sales tax rate for South San Francisco California is.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business. Identify a Letter or Notice. The latest sales tax rate for San Francisco CA.

What is the sales tax rate in San Francisco California. California City County Sales Use Tax Rates. The Office of the Treasurer Tax Collector is open from 8 am.

Method to calculate San Francisco County sales tax in 2021. 1788 rows Find Your Tax Rate. California Sales and Use T.

This is the total of state county and city sales tax rates. This is the total of state and county sales tax rates. Puerto Rico has a 105 sales tax and San Francisco County collects an.

The South San Francisco California sales tax is 750 the same as the California state sales tax. Ax Rates by County and City Operative October 1 2022 includes state county local and district taxes. 2020 rates included for use while preparing your income tax deduction.

You can call the San Francisco County Tax Assessors Office for. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. The average cumulative sales tax rate in San Francisco California is 864.

What is the sales tax rate in South San Francisco California. This includes the rates on the state county city and special levels. This is the total of state county and city sales.

The latest sales tax rate for South San Francisco CA.

California Sales Use Tax Guide Avalara

Property Taxes By State Embrace Higher Property Taxes

2022 S Most Expensive Counties To Buy Residential Land Lawn Care Blog Lawn Love

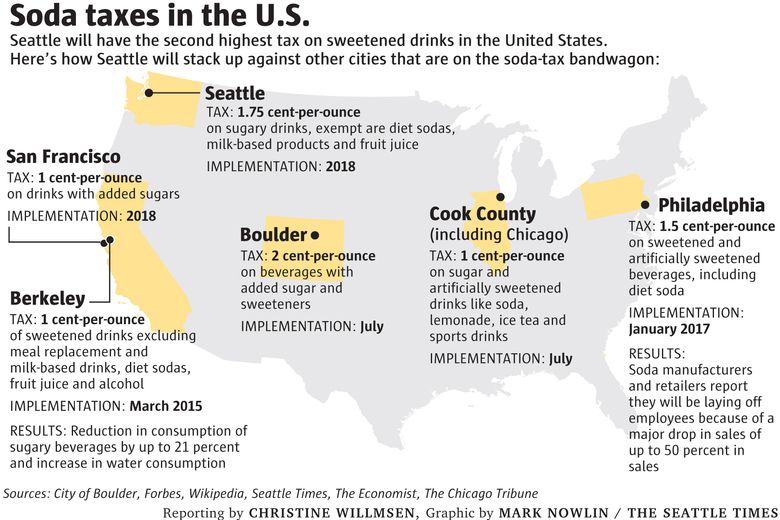

Seattle Isn T The First City To Tax Soda Here S How We Stack Up The Seattle Times

Santa Clara County Supervisors Push Sales Tax Measure For November Ballot The Mercury News

Which Cities And States Have The Highest Sales Tax Rates Taxjar

A Golden Opportunity California S Budget Crisis Offers A Chance To Fix A Broken Tax System Tax Foundation

States With The Highest And Lowest Sales Taxes

Food And Sales Tax 2020 In California Heather

Understanding California S Sales Tax

New York Taxes Layers Of Liability Cbcny

California Sales Tax Guide For Businesses

Stripe Tax Automate Tax Collection On Your Stripe Transactions

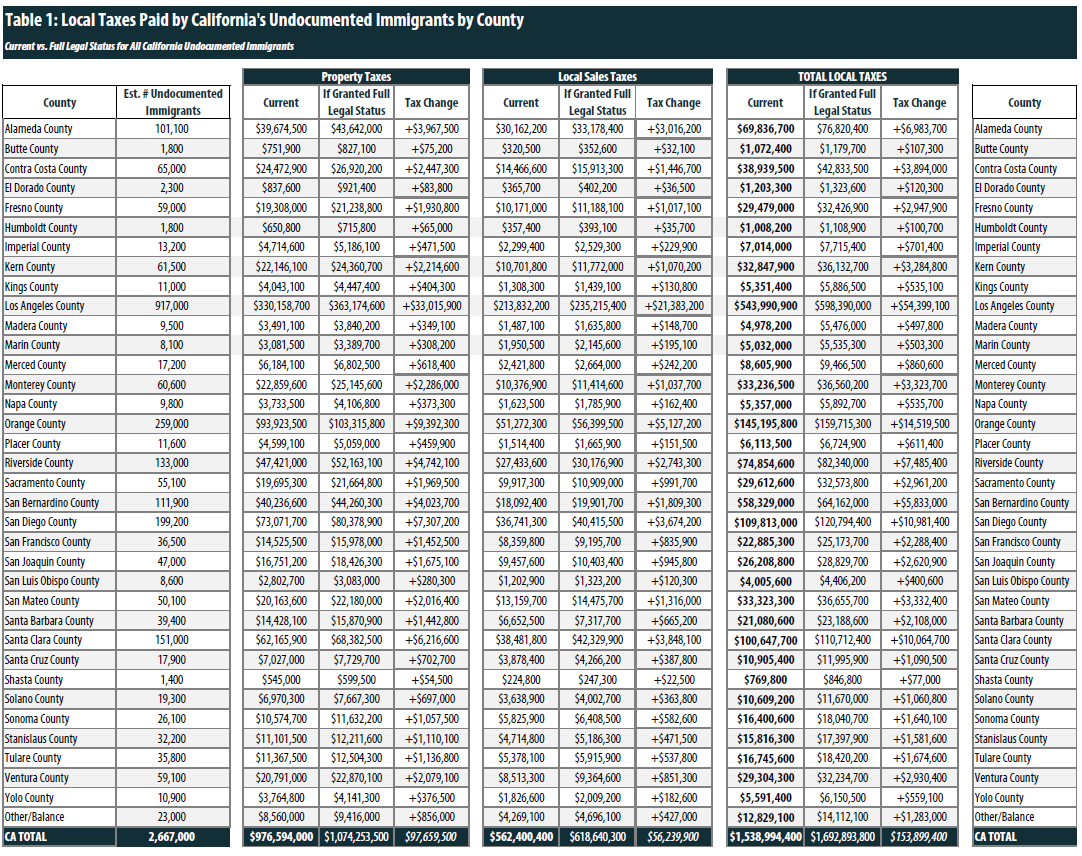

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

California Sales Tax Rate Changes January 2013 Avalara